Orbital ATK, CRS-2, and the return of “The Stick”by Jeffrey Smith

|

| Antares plays to what has been Orbital’s strength; namely, taking different parts that are separated in time, place, and purpose, and combining them to make something new that was never imagined by the original designers. |

Orbital Sciences used a LEGO-building-block approach to design the new rocket and spacecraft. The Cygnus cargo ship is a combination of a European cargo compartment whose heritage dates back to the 1970s as a laboratory for the Space Shuttle, and is moved around in space by a modified satellite bus from a company that OSC purchased in 1997. Orbital took a similar approach on the rocket with a nose cone from a company in California, a small upper stage rocket motor from long-time partner ATK, and a first stage that was a combination of propellant tanks from Ukraine and old Soviet-era rocket engines left over from the USSR’s failed Moon landing effort. While this supply chain may seem overly complicated, it plays to what has been Orbital’s strength; namely, taking different parts that are separated in time, place, and purpose, and combining them to make something new that was never imagined by the original designers.

In the world of 2008, these decisions made sense. America has long enjoyed good relations with Europe, which is why they designed the laboratory for the shuttle in the first place. Also, America, Ukraine, and Russia all enjoyed good relations with each other and were cooperating on a number of space programs ranging from rockets to the ISS. OSC had high hopes to repeat the success of another supplier for NASA’s COTS program: SpaceX. There were efforts to sell the Antares rocket for commercial satellite launches, NASA science probes, and particularly lucrative contracts to launch American military satellites. These projections, as well as global politics, have dramatically combined to prevent the same sort of success that SpaceX has enjoyed with its Falcon 9 rocket.

The geopolitics, they are a changin’

America and Russia are now at odds with each other over influence in Ukraine. This has caused a rise in tensions that has affected areas where there was previously cooperation. This chilling of relations has also caused a political tug-of-war in America resulting in the planned phaseout of Russian components, notably the RD-180 engine, in rockets that launch American defense satellites.

While America and Russia disputed events that took place on the ground, SpaceX was turning the space world upside down. With a fast-paced Silicon Valley ethos, ultra-low prices, and a desire to design and build everything in-house, SpaceX disrupted the longtime system where even aerospace companies that lost a major contract could at least supply smaller components to the winner, and thus survive to compete another day. Orbital and the rest of the global space industry have responded to this by changing business practices in an attempt to better compete for contracts at lower price points.

As part of this reshuffling of the aerospace industry, Orbital Sciences decided to merge with longtime partner and supplier ATK to form Orbital ATK. This merger, finalized in early 2015, was a natural one for both companies. For decades, ATK made the rocket motors and Orbital put them together and launched them for applications ranging from the Pegasus satellite launcher to interceptors that defend America from nuclear attack. With the merger, Orbital ATK now has increased access to large rocket motors and has the incentive to find new uses that would lead to additional sales of these same motors.

The shuttle is dead, long live the SLS

Since the 1970s, ATK (and its predecessor companies) has produced the largest solid rocket motors in the world to hurl NASA’s Space Shuttle off the launch pad and into space. Hundreds of these solid rocket boosters (SRBs) have been used to launch the shuttle, with others being tested on the ground. With the shuttle program ending in 2011, the need for these solid rocket motors abruptly ended. While both the ill-fated Constellation program and its successor, the Space Launch System (SLS), have both incorporated upgraded SRBs in their designs, the occasional ground test doesn’t come anywhere near the 18 SRBs that were used in 1985 to launch a record nine shuttle missions. Today, Orbital ATK is sitting on huge excess manufacturing capacity, which costs money to maintain and could be put to other profitable uses for the company.

| Orbital ATK has been trying to resurrect an idea that almost saw the light of day once before: “The Stick.” |

Orbital ATK and NASA aren’t the only organizations affected by the end of the shuttle program. The US military is the other major user of solid rocket motors. The shuttle accounted for some 70 percent of all solid rocket motor production capacity in the US. Without that production, the normal overhead is spread out over a smaller number of programs; one military program claimed it increased their costs by 85 percent. While ballooning budgets for military programs is nothing new, it shows a very real pain that the US military is feeling, a pain that Orbital ATK would be happy to alleviate.

The Stick, Ares I, or NGL?

Turning back to launching cargo for NASA, Orbital ATK has won an additional contract to continue shipping supplies to the ISS from 2020 to 2024. While NASA hasn’t announced exactly how often Orbital ATK will be launching supplies to the ISS, the current rate of about two launches per year seems likely to continue.

Even though this contract seems firm, which rocket Orbital ATK chooses to launch the cargo into space isn’t. Prior to the most recent Antares flight, Orbital ATK’s vice president of advanced programs, Frank DeMauro, said that “Orbital ATK plans to launch its remaining CRS-1 cargo missions with the Antares rocket, but the company may change the launch vehicle during CRS-2, ‘depending on what NASA wants.’” [Since then, Orbital ATK has announced it will launch its next Cygnus mission on an Atlas V after discussions with NASA to provide additional cargo and schedule assurance.]

With that in mind, Orbital ATK has been trying to resurrect an idea that almost saw the light of day once before: “The Stick.”

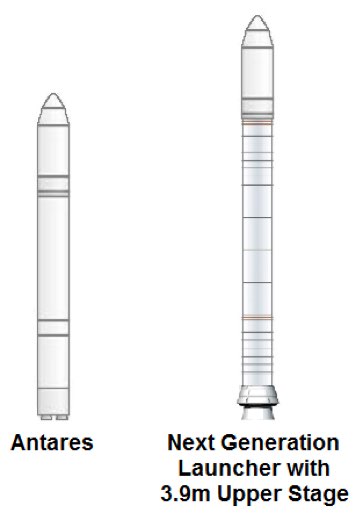

The Antares rocket and a possible version of the NGL. (credit: www.historicspacecraft.com and Orbital ATK) |

The Stick is a concept for using a single Space Shuttle SRB as the core of its own launch vehicle. This actually flew once in the form of the Ares I-X test flight, and after that program was canceled, ATK tried (unsuccessfully) to revive it as the Liberty rocket.

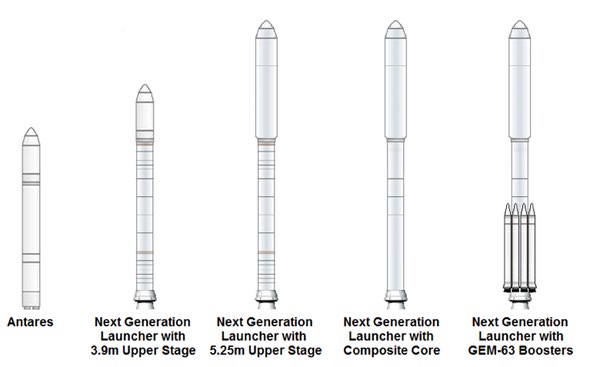

The new rocket currently bears the placeholder name of Next Generation Launcher (NGL), obviously to be changed at a later date to something more exciting if the program moves forward (Antares II, perhaps?) This new incarnation simplifies the rocket to meet the immediate needs of NASA’s CRS-2 contract with plenty of room to grow in the future. Whereas the original Space Shuttle SRBs combined four individual motor segments, which were stacked one on top of the other, this new rocket would initially cut those up into smaller pieces. The core of this new rocket would be formed by stacking a one-segment booster (renamed the Castor 300) on top of a two-segment booster (with the predicable name of Castor 600).

By simply replacing the Ukrainian and Russian components on Antares with Space Shuttle vintage hardware it can already build, Orbital ATK can use the NGL to continue meeting its NASA commitments. Using Orbital ATK’s published numbers and a little bit of math, it’s easy to show that the initial NGL will be able to deliver some 5.5 metric tons to low Earth orbit; coincidentally, nearly the exact weight of a fully loaded Cygnus. That represents everything under the nosecone on the current Antares rocket (the nosecone itself, the Cygnus cargo spacecraft and the Castor 30XL upper stage), which can be directly transferred onto the core of the new NGL and still deliver all of its current cargo to the ISS. The change is made easier due to the fact that Antares and its nosecone are 3.9 meters in diameter, which is very similar to the SRB’s 3.7-meter diameter.

| This new rocket seems to make logical sense for Orbital ATK and all interested parties. |

In May, Orbital ATK’s director of strategy and business development, John Steinmeyer, said the NGL could be ready for its first flight in 2020. This is (also coincidentally) the same year they would need the rocket for its first CRS-2 cargo delivery for NASA. To meet this aggressive schedule, Orbital ATK needs to commit to developing the rocket by early 2017. This would give Orbital ATK only three years to replace the Antares first stage with two separate solid rocket motors. To put that in perspective, it took five years from the initial Antares announcement before its first flight, and it even took Orbital ATK two years just to reengineer the Antares rocket with new Russian rocket engines to replace the old Russian rocket engines that were blamed for the failure in 2014.

One rocket, so many stakeholders

This new rocket seems to make logical sense for Orbital ATK and all interested parties. It benefits from the merger with ATK by taking advantage of the underutilized production facilities to generate revenue while achieving a nearly vertically integrated launch system, just like SpaceX has done. Also, “insourcing” the entire rocket allows Orbital ATK to capture all of the expenses (and profits) associated with overhead. The fact this vertical integration would all be located in the US would also allow Orbital ATK to compete for military contracts from which they are currently barred because of the use of Russian rocket engines. These contracts are so lucrative that competitor SpaceX was willing to sue their potential customer, the Department of Defense, just to be considered to offer rocket launches.

The NGL is attractive to Orbital ATK’s customers as well. NASA is trying to reduce the annual costs of their SLS rocket, which uses the same SRB technology, to $1.5 billion per year. Commercializing and spinning-off the production of SRBs would be seen as a way to reduce and spread the fixed costs of SRB production across multiple projects.

Eliminating SLS-specific technologies that are holdovers from the shuttle era has also been identified as a way to reduce costs. While the SRBs during the shuttle era were recovered and reused, NASA is not planning to recover the SRBs used for the SLS and will not have to maintain the fleet of ships used to fish them out of the ocean. In that same vein, images for future versions of SLS show upgraded SRBs with carbon composite rocket motor cases, a technology that Orbital ATK already uses on all of its modern commercial rocket motors. Composite rocket motor cases are not reused due to heat damage they experience during normal operation. Also, the old SRBs use what is now a shuttle-specific PBAN rocket propellant formula, as opposed to the higher performance HTPB propellant used on Orbital ATK’s other solid rocket motors. Finding commonality with Orbital ATK’s other solid rocket motor processes would give NASA access to new technologies developed since the 1970s and will free NASA from having to support these custom technologies. NASA has already funded demonstration programs for these changes.

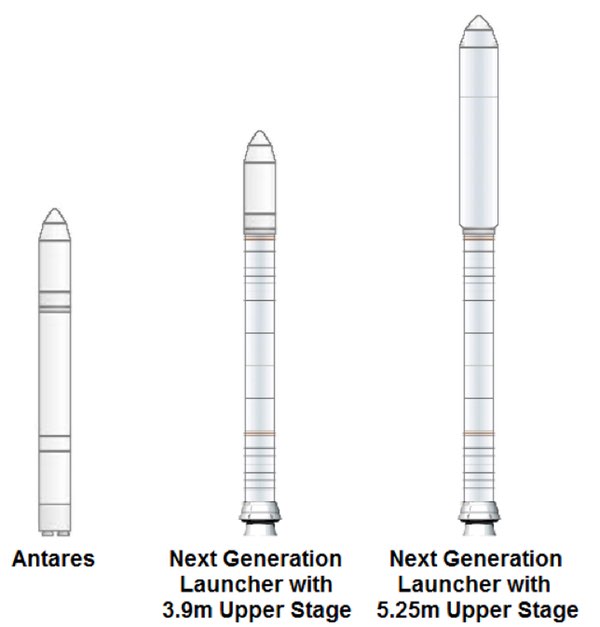

The US military also sees value in the NGL. Their doctrine of “assured access to space” means the military always wants additional providers to launch their valuable payloads in case a particular rocket system is experiencing problems that ground it for an extended period. The US military is already familiar with the technologies of NGL, having launched many payloads on the shuttle. The US Air Force is even funding work that will support the initial version of NGL and future upgrades, like a high-energy upper stage to meet the military’s needs. This improved upper stage would be sized to fit the military’s largest payloads at 5.25 meters in diameter, fueled by liquid oxygen and liquid hydrogen, and capable of sending 5.5 metric tons to a geostationary transfer orbit. The NGL also shares many characteristics with rockets used for defense purposes. The possibility of sharing costs will be very attractive to the military, which needs a constant supply of tactical rockets and is also developing new ICBMs.

The Antares rocket and possible versions of the NGL. (credit: www.historicspacecraft.com and Orbital ATK) |

But, just as having too many cooks in the kitchen can make cooking impossible, too many stakeholders will invariably increase complexity for Orbital ATK. For example, the company will be both assisted and hindered by GFE, Government Furnished Equipment. The production facilities that produced the shuttle and soon-to-be-SLS SRBs were paid for with taxpayer dollars and are still owned by the US government. In fact, the original design agent for the SRBs was NASA’s Marshall Space Flight Center in Alabama, which owns all of the intellectual property behind the design. Orbital ATK and NASA will have to navigate these issues.

| The example of Orbital ATK and the NGL is an instructive microcosm of the rapidly changing space business and how government and individual companies are responding to those changes. |

While the design and production facilities pose one set of challenges for the NGL, assembling and launching it will bring the different priorities of each stakeholder into sharp relief. Unlike Antares, which is relatively undisturbed as the largest user of NASA’s Wallops Flight Facility in Virginia, the NGL will use former Space Shuttle facilities at NASA’s Kennedy Space Center in Florida to prepare and launch the rocket. These facilities have been refurbished for the SLS, and the NGL will have to share the same facilities that have been optimized for a different rocket and launch from a pad where the SLS will likely take precedence over launches for commercial and perhaps even defense customers. NASA will be happy to spread the workforce and maintenance costs of these facilities over additional programs, but will be less willing to modify equipment in a way that would negatively impact their own SLS. Orbital ATK will then experience the exact opposite problem when it launches from Vandenberg Air Force Base, where NGL will use military facilities and be forced to schedule commercial and NASA launches around the needs of the US military.

In order to make all of these headaches worth their while, Orbital ATK has said they need between five and six launches per year for the NGL to make economic sense. While Antares could be economical with just two launches per year, Orbital ATK has the extra expense of developing the new Castor rocket stages. Even if NGL can actually be profitable at only four launches per year, the two annual launches for NASA’s CRS-2 program still leaves Orbital ATK needing at least two more launches each year from other sources to make the business case close.

The Antares rocket and possible versions of the NGL family of rockets. (credit: www.historicspacecraft.com and Orbital ATK) |

A merger of equals, or, keeping it in the Family

The example of Orbital ATK and the NGL is an instructive microcosm of the rapidly changing space business and how government and individual companies are responding to those changes. In particular, the NGL brings together in one single rocket all the current ideas for how to compete in this new business environment: designing a new rocket to lower costs, vertically integrated rocket companies, the need to win lucrative military contracts, government agencies turning to private companies for services previously provided by the government itself, spreading overhead and fixed costs across multiple programs, and commercializing systems and facilities paid for with taxpayer dollars.

When Orbital Sciences and ATK announced their merger, they declared it a “merger of equals.” Such a merger makes sense if Orbital can find new uses for existing ATK rocket motors and ATK can design and build new building-block rockets for Orbital to assemble and launch. But with the new opportunity comes the responsibility for both halves of the marriage to successfully execute on their particular strengths. If the combined Orbital ATK can’t keep these business opportunities in the new family, then the hoped-for benefits of vertical integration will not come to pass.

Before Orbital ATK can even worry about navigating the particulars of the two largest space bureaucracies, they need to convince both organizations that NGL will serve everyone’s immediate launch needs and help lower each organization’s costs for things that have nothing to do with launching cargo to the ISS. In this way, NGL isn’t just a rocket: it’s a solution to a whole group of problems. Everyone loves a bargain, and if Orbital ATK can convince NASA and the US military that such a rocket can fulfill their launch needs while also lowering costs for projects like SLS and ballistic missile production, they will lock in the two most-demanding (and highest-paying) customers in the space business.

We’ll have to wait until 2017 to find out what happens. I just hope they pick a good name.