Effects of changing economics on space architecture and engineeringby Gary Oleson

|

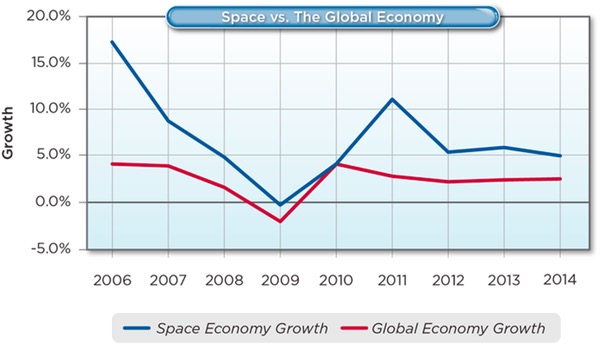

| The global space economy did not contract, even in 2009, and its growth exceeded the general economy in every year except 2010, reaching $330 billion in 2014. |

The new imaging satellites and other small satellites, or smallsats, have created a large and growing demand for small, affordable launch vehicles. Over 20 new launch vehicles are being developed to serve this demand. At the other end of the size spectrum, the Falcon Heavy is poised to offer low-cost super-heavy launches. However, none of these new launch vehicles have yet had their first test flight. Many public and private opportunities enabled by these new launch vehicles have not been identified.

The joint effects of all these changes will expand the trade space for aerospace systems engineering. The scale of the changes will challenge engineers to question not only their traditional spacecraft designs, but also their overall architectures and even their lines of business. Large rewards await those who adapt most effectively to the new opportunities.

The global space economy

Growth in the global space economy has consistently outperformed global economic growth over the last decade, as shown in Figure 1. The global space economy did not contract, even in 2009, and its growth exceeded the general economy in every year except 2010, reaching $330 billion in 2014.

Figure 1. Space economy annual growth rates compared with the global economy |

All commercial space markets showed healthy growth in 2014 except the small insurance sector. The leading growth segments in 2014 were satellite radio and launch, but launch has been volatile year to year. All the Earth observation revenue growth in the last three years occurred in 2014.

Although US government space budgets grew in 2014, they declined significantly during the previous two years, with the sole exception of growth in the National Oceanic and Atmospheric Administration (NOAA) budget. This contrasts with sustained vigorous grow in non-US government space budgets.

In addition to the strong historical growth of the space economy, space industry startups are showing dramatic growth. Space startup investment had a compound annual growth rate (CAGR) of 180 percent during 2012–2015. Space startups outpaced every other industry group, including bitcoin at 151 percent and photo sharing at 150 percent. Startup space ventures attracted $2.7 billion of investment and debt financing in 2015, of which $2.3 billion was investment, a historical record. Of the $2.3 billion total investment, $1.8 billion came from venture capital, more than the previous 15 years combined.

Space industry markets

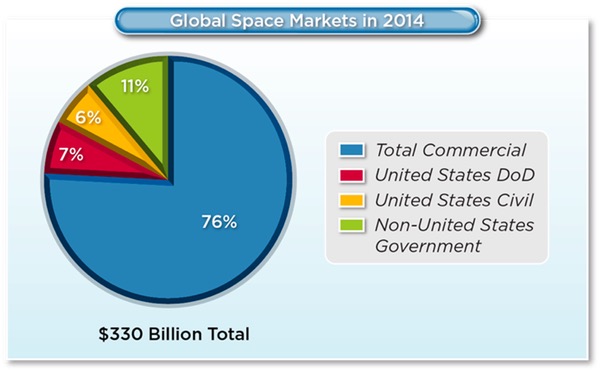

To explain this rapid growth in investment, we need first to understand the structure of space industry markets. Commercial markets make up more than three-quarters of space industry markets, mostly driven by global telecommunications. Commercial remote sensing is a small but developing segment, making up about two percent of commercial products and services. The remaining quarter is almost evenly divided between US and non-US governments, as shown in Figure 2. The US government portion is, in turn, almost evenly divided between national security space programs and civil space programs.

Figure 2. Comparison of major space market sectors |

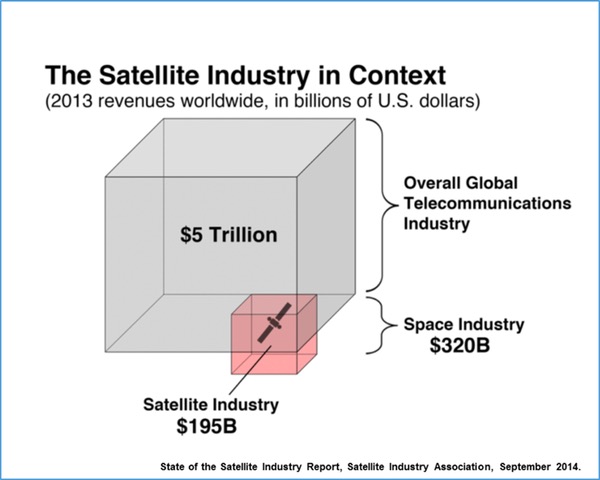

The key to understanding these market segments is to look outside the space economy. Each segment of the space economy is driven by a larger associated market that includes and funds a much smaller space segment. For example, space telecommunications is part of the much larger $5 trillion global telecommunications market, as shown in Figure 3.

Figure 3. Comparison between the space industry and the global telecommunications industry |

Satellite industry revenues, which made up 61 percent of the space industry, equaled about 4 percent of global telecommunications revenues in 2013. The largest segment of the space industry is a very small segment of its dominant market.

| Every mature segment of the space economy analyzed appears to command revenue equaling about four percent of its associated market. Is this a coincidence or is there an underlying logic that drives this relationship? |

The same pattern appears to hold in the rest of the space economy. Most of the space revenue that doesn’t come from commercial telecommunications comes from government spending on national security or civil research and development services. Commercial telecommunications and government spending make up 98 percent of the current space economy. US government spending data for 2014 (non-US government spending was not analyzed for this essay) show that:

- National security space spending was $22.5 billion, or about 4 percent of the $603 billion total US national security spending.

- Civil space spending was $20.3 billion, or about 4 percent of the $465 billion total US public and private research and development (R&D) spending.

Every mature segment of the space economy analyzed appears to command revenue equaling about four percent of its associated market. Is this a coincidence or is there an underlying logic that drives this relationship?

Analysis and hypothesis

The market segments of the space domain have almost always developed and matured as subsets of much larger commercial markets or national interests. Space offers unique enhanced value to interests that existed prior to the space-based developments. Space might best be regarded as a place, much like a new continent, within which market segments develop as they are able to cost-effectively contribute to existing values or interests.

US space development initially consisted mostly of missiles and rockets developed as a small subset of the national military sector. Science was a secondary segment, smaller than the military segment and a small subset of the science sector. Both national security and science have grown and diversified their value over the years. National security uses of space, in particular, have grown beyond missiles to include intelligence collection, communications, and precision navigation. Capabilities derived from both the national security and science sectors have grown to become essential public services that include weather forecasting, environmental monitoring, position finding, and telecommunications timing.

Space telecommunications, military space, and space science all started over five decades ago, making them mature markets. While it could be coincidence that each has achieved a market penetration of about four percent, it seems more likely that a common dynamic drives their market shares. The costs of space services have been both stable and high for most of the last five decades. It takes a high-value service to justify the high expense of space.

The suggested hypothesis is that the historically high cost of space operations drives the consistent pattern for space market segments to operate as a small portion of much larger market sectors. In the face of high costs, a space industry sector can attract significant revenue only when it offers a service that:

- Can deliver a compellingly high value that

- Can be delivered at an affordable price and

- Can only be delivered from space and

- Can be scaled to make a small penetration into a very large market.

In the currently dominant markets, these compelling value propositions command about four percent of the available revenue. This hypothesis suggests that the winning strategy for new or developing space industry segments is to focus on delivering on compelling value propositions aimed at winning a small share of very large markets. Other strategies can only be successful if the cost of operating in space declines significantly.

There is one illuminating exception to this hypothesis that needs to be addressed before the effects of this hypothesis are explored.

The exception

The one exception to the historical pattern of low-percentage market penetration was the decade when the Apollo Project dominated the competition between the United States and the Soviet Union for prestige and technological supremacy. After Sputnik 1 was launched, national prestige became an overwhelming interest for the US and the USSR, and was the driving force behind the Apollo Project. The 1957–1969 period is the only time space has dominated any US national interest or market sector. In the peak years of this limited period, NASA alone commanded over four percent of the US national budget and about one percent of the entire national gross domestic product (GDP), with up to 70 percent of NASA spending going to support Apollo.

| Cost reduction is a universal enabler, enabling greater penetration of existing markets and creation of new markets. |

The market served by the Apollo Project might be called the intangibles market, commanded by national prestige and also including such values as international relations, educational stimulus, and the spirit of exploration. The size of the intangibles market has not been measured, but it is fair to assert that Apollo dominated it during the 1960s. Since the end of Apollo, the US has committed a consistent budget of about $8 billion per year in constant 2014 dollars to human spaceflight, less than 20 percent of the US space budget and 2 to 3 percent of the total space economy. While prestige and international relations continued as a US space value with the Apollo-Soyuz mission and continues today as a function of the International Space Station and other international space projects, it has clearly stabilized as a relatively minor market segment.

Impacts of new developments on architecture and engineering

The hypothesis defined above gives us tools to assess the impacts of new space developments. The economic potential of current and future space developments can be assessed by evaluating the size and urgency of the pre-existing industries, markets, or national interests they propose to serve. That provides a measure of the total revenue available in each industry. An assessment of the potential for space-based industries to penetrate each market would then give a rough upper bound on the size of the associated space industry sector.

Once new space services become established, however, they can, and often do, transform the original value propositions. The Global Positioning System (GPS), for example, has transformed the nature of maps and position-finding in a very short time. The US Air Force has greatly accelerated growth of commercial GPS applications by providing the space portion of the service for free, unlike most other commercial space markets.

New space industries are being enabled by developments in technology and system design that enable space services to be delivered at lower cost. These developments frequently enable new missions and services that were unaffordable prior to the developments. Cost reduction is a universal enabler, enabling greater penetration of existing markets and creation of new markets.

Foremost among the recent developments are advances in miniaturization that enabled affordable smallsats to deliver valuable services and the availability of ridesharing to give the smallsats inexpensive access to orbits. Also, advances in launch vehicle design and manufacturing are enabling reductions in launch costs for medium to heavy spacecraft.

The new space industries currently being developed include commercial remote sensing, advanced telecommunications, space resource extraction, and commercial space stations. Of these, only commercial remote sensing and advanced telecommunications have begun delivering services. The hypothesis suggests these developments will be successful only to the extent that they can deliver compelling value to large markets at an affordable price.

Earth remote sensing as an example

The emergence of new Earth observation services has attracted much attention in the last two years, but the new services have barely gotten started. Revenue from the new services is still a small subset of the $2.3 billion in Earth observation revenue last year. Only a few of the startup companies have placed their first collection systems in orbit, and none have come close to completing a baseline constellation. However, a few examples serve to show the explosive nature of the current growth trend.

Planet Labs, a stereotypical Silicon Valley startup that got its start at the NASA Ames Research Center, had $65 million in venture capital investment through mid-2014, the year their first test constellation of Earth observation satellites was launched. By that time, they had booked over $65 million of new business. By mid-2015, their investment had grown to $183 million, their booked business had grown past $200 million, and the company was valued at $1.1 billion. Another example is Skybox Imaging, which had $91 million in financing and was purchased by Google for $500 million in 2014, less than two years after launching their first Earth observation satellite.

It should be noted that both Planet Labs and Skybox are still flying prototype systems, and neither has anything resembling their planned baseline constellations in orbit yet. One obstacle for all the new Earth observation services is that affordable smallsat launch vehicles are not yet available to give them dedicated rides to the orbits they want.

| It is not sufficient to produce a good technical product. The payoff comes when the product is delivered to end users in a form they can use to justify purchasing the service. |

Company officials in this industry say their customers are so hungry for data that additional vendors actually stimulate more demand by enabling new kinds of analyses. The full spectrum of analyses designed to use these data are still being developed as data availability makes them possible for the first time. Two recent developments illustrate the forms these analyses can take. The first focuses on integrating space and non-space data, while the second focuses on integrating space data from multiple sources.

Google recently rebranded Skybox Imaging as Terra Bella and gave it a new mission: “As Google revolutionized search for the online world, we have set our eyes on pioneering the search for patterns of change in the physical world.” Skybox founders continued, “As we have engaged with thousands of potential users, we have been struck over and over again by a simple truth. There is an incredible opportunity for geospatial information to transform our ability to meet the economic, societal, and humanitarian challenges of the 21st century, but satellite imagery represents only one part of the puzzle.” Terra Bella is working with diverse geospatial data sources and analysis tools to convert imagery and non-imagery data into information designed to help people make better decisions.

The same week that Google announced Terra Bella, Space Commercial Services Global Information (SCSGi), a private space company in Cape Town, South Africa, announced a data service called the African Satellite Constellation that integrates imagery from seven companies operating 13 space imaging systems, including one radar satellite. The service is designed “to provide monitoring and management services anywhere in Africa at least once a day with a minimum turn-around time of 30 seconds to 6 hours.” SCSGi intends to provide “reliable, dependable, real-time high-quality data obtained through satellite imagery to support a wide range of services such as crop assessments, forestry management and deforestation, environmental protection, fire warnings, insurance risk assessments, address validation, infrastructure monitoring, urban and rural development, population counts, border control and maritime security.”

Information integrators like Google and SCSGi may provide essential services in delivering the value of space imagery to people who can use it to make better decisions. These services are important because it is not sufficient to produce a good technical product. The payoff comes when the product is delivered to end users in a form they can use to justify purchasing the service.

A thought experiment

To judge the prospects for the future of commercial Earth observation, it is necessary to assess each of the four elements of the hypothesis. The financial track records of Planet Labs and Skybox suggests that each in their own way is producing high-valued products at an affordable price, thus satisfying the first two elements for now. The precise details of their value propositions are not public, but the value is clearly enough to attract large investments and customer bookings.

Competition from non-space alternatives such as aircraft and drones will be a concern that only time will test. However, the price of space imagery is dropping rapidly as smallsat costs drop, making space services more cost competitive. Also, aircraft cannot cover denied areas and have an expensive problem scaling to cover the entire globe. The competitive prospects for the new space services look good for these reasons.

The next step is to understand and estimate the size and growth potential of the markets for space-based observations. The traditional markets for these observations have included exploration for resource extraction, agriculture management, land use planning, environmental science, emergency response, and national security.

Planet Labs, for example, lists their markets as including agriculture; energy and infrastructure; finance and business intelligence; forestry; government (including intelligence, law enforcement, and economic development); mapping (including land use); social impact (including disaster response and environmental monitoring); maritime insurance; transportation monitoring; and others. In July 2015, the author asked Chris Boshuizen, co-founder and then chief technology officer of Planet Labs, what he could say about their markets. He replied that their largest sales were to the agriculture, resource extraction, and mapping industries.

There are differing estimates of the annual revenues from global agriculture and global resource extraction, centering on about $10 trillion per year for the two sectors combined. The revenues of the mapping industry are inconsequential in comparison.

The thought experiment is to imagine that the new commercial Earth observation services taken together capture not 4 percent, not 1 percent, but 0.1 percent of the total revenue from agriculture, resource extraction, and mapping. That is to say, assume the new services can improve the functioning of these industries across the entire globe by at least a tenth of a percent. The resulting revenue stream would total $10 billion per year shared among all the new services. This would give a total addressable market that is equivalent to a major US space agency and equals or exceeds the entire space budgets of most countries.

This thought experiment leaves out the other dozen or so markets listed by Planet Labs. Of the omitted markets, governments and business intelligence by themselves have huge potential. The experiment also ignores markets being pursued by other companies but not by Planet Labs, such as weather data. Even without estimating the sizes of any of the other potential markets, the clear conclusion of this thought experiment is that there is more than enough revenue potential to sustain the new Earth observation services through a period of substantial growth, on one condition.

The one remaining condition is that the new services can be scaled to address entire global markets. Ways must be created to deliver information to end users around the globe in forms usable by them. In many cases, new infrastructure is needed to enable the data to be used. Methods appropriate to enable precision agriculture in Asia, for example, may be different from those needed in Africa or Latin America. This will be an architectural problem as much as a financial and economic problem.

| Without looking too closely at the individual developments, it is clear that any significant expansion of the global telecommunication industry could produce revenues that would be large in comparison to the current space economy. |

The architecture problems will include deciding what information to collect, how to process the data, how to integrate and analyze the data, and how to distribute the resulting information to the end users in formats that they can use. In many cases, this involves ways to spread the cost over large numbers of users and to give the users the physical means to make use of their improved decision-making ability. The examples of Terra Bella and the African Satellite Constellation described above show that people are already engaging with these problems.

While this essay uses commercial Earth observation as an example, other important markets are currently being developed. Perhaps the most immediate are new developments in space telecommunications. In particular, several major investors have recently announced new ventures to provide Internet service to consumers directly from space. These follow the introduction of Internet and mobile backhaul services to emerging markets by O3b Networks. The value of these new ventures derives partly from over-the-top penetration of existing Internet markets, bypassing local Internet service providers.

Larger value will probably come from expanding Internet service to underserved and emerging markets around the globe. This could fuel significant expansion of the $5 trillion telecommunications market. However, these systems would require that communications be managed among hundreds and thousands of satellites as well as with millions of ground units—a challenge that should provide opportunities for architects and engineers. Without looking too closely at the individual developments, it is clear that any significant expansion of the global telecommunication industry could produce revenues that would be large in comparison to the current space economy.

Developments in smallsat launch

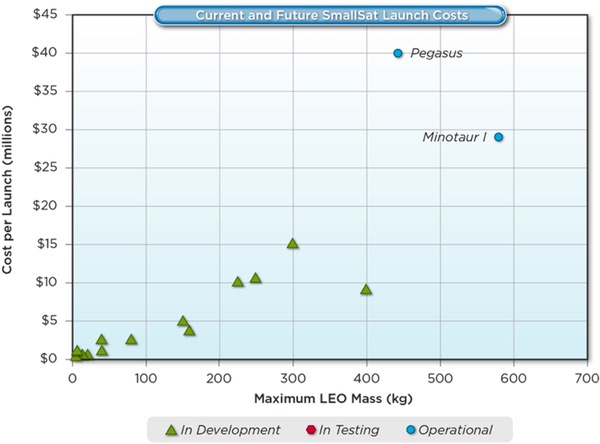

The lack of dedicated launch vehicles to deliver smallsats to their preferred orbits has attracted more than a dozen potential new entrants to the launch services business. These have received enough attention that they will not be described individually here. The important thing to note is that, at the time of this writing, not one has had their first test flight, although several are scheduled to begin testing the next two years. The range of the advertised cost and performance of some of them is shown in Figure 4, which also shows two of the smaller operational launch vehicles for reference purposes.

Figure 4. Smallsat launch costs and performance |

It is worth noting that, unlike most previous efforts to create new commercial launch vehicles, this wave of vehicle development is demand-driven. For this reason alone, it is highly likely that some new launch vehicles will succeed. If some fail, the demand will still be there and will attract new efforts to supply the need. However, since none of them are operational yet, it is highly unlikely that all the potential uses for such small and relatively inexpensive launch vehicles have been thoroughly explored. Despite all the attention already given to new smallsat launchers, many potential users will begin serious consideration of new mission concepts only after they see what actually flies.

A logical conclusion is that the era of smallsats is still only in its beginning stages. In particular, if any of the launch vehicles actually deliver on plans to perform smallsat launches with short lead times and short turnaround times, many new smallsat applications may be enabled. This will offer designers many interesting and profitable challenges in system architecture and system engineering. The challenge of creating smallsat systems that are effective, responsive, and affordable will engage designers for years to come.

An era of “hugesats”?

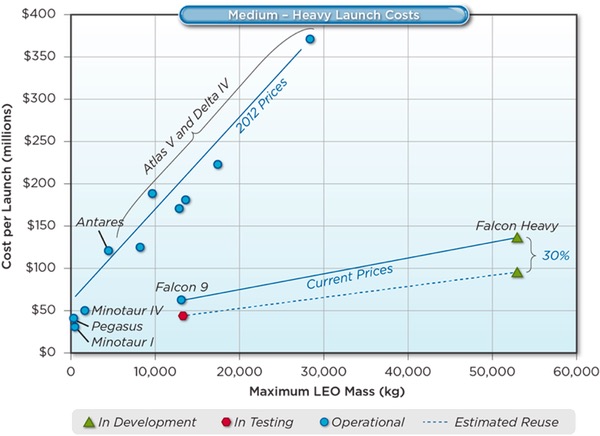

In contrast to the attention lavished on smallsats and smallsat launch, very little attention has yet been given to the onrushing prospect of affordable super heavy launch. The first entrant in this domain is the Falcon Heavy, as shown in Figure 5. At this writing, the first launch of the Falcon Heavy is scheduled for November 2016.

Figure 5. Medium to heavy launch costs and performance |

| An entire multi-module space station could reach orbit on one launch for no more than it costs to launch a communications satellite today. |

When the Falcon Heavy launches successfully, it will make very heavy spacecraft more affordable than ever before. It is designed to deliver 53 metric tons, almost twice the payload of the Delta IV Heavy (currently the most powerful launcher), for about what many medium launches have recently cost. The first launches will not exploit all the possibilities. Some single spacecraft that are too heavy for the Falcon 9 will move to the Falcon Heavy just to save money. Some Falcon Heavy launches will carry two spacecraft that are together too heavy to be carried by anything less than a Delta IV Heavy.

More innovative possibilities have not been widely explored or, at least, received much attention. One possibility would be to enable newly affordable capabilities by dramatically relaxing the mass limits on spacecraft design. How much money might be saved and what new capabilities might be enabled by simply building things big and heavy?

If the core modules of the Falcon Heavy are successfully reused, the cost of super heavy launch will drop even more. What will designers invent to make use of 53 metric tons in orbit? That is a challenge to architectural ingenuity that may occupy much of the next decade and beyond.

One possibility is that the Falcon Heavy might smooth the road to building commercial space stations. One Falcon Heavy could launch more than three and a half times the mass of the US Destiny laboratory on the ISS. This suggests that an entire multi-module space station could reach orbit on one launch for no more than it costs to launch a communications satellite today.

Global healthcare, tourism, and energy production are among the large existing markets that could provide support for commercial space stations. Sovereign nations, especially wealthy nations that do not currently have a human spaceflight program, are likely to provide much of the initial market for commercial space stations, but commercial markets are likely to provide most of the long-term growth.

Biomedical research conducted in space on the Space Shuttle and the ISS has just developed beyond the proof-of-concept stage and yet has produced some startling breakthroughs. Mainstream biomedical companies are very interested in exploiting the unique research environment, but are severely constrained by current severe limits on research staff in orbit, limited communications, and by a total lack of frequent parcel service between space and the ground. Development of commercial space transportation and commercial space stations could provide the means for significant expansion of biomedical research, as well as agricultural, materials, and industrial processes research. Healthcare is a $6.5 trillion industry (more than $2.2 trillion in the US alone), and global biomedical research totals close to $300 billion. These alone could support a major expansion of space industries.

Tourism is a $1.25 trillion global industry that is growing at 10 percent per year. Several individuals have paid $20 million or more for a 10-day trip to the ISS and at least one reserved a $150-million trip to fly around the Moon. Commercial space stations could easily enable a multibillion-dollar tourism industry.

Conclusion

Almost all of the mature segments of the space economy seem to follow what might be called a “four-percent rule.” They each succeed by making a small penetration into a very large economic sector. This suggests the hypothesis that, in the face of high costs, a space industry sector can attract significant revenue only when it offers a service that:

- Can deliver a compellingly high value that

- Can be delivered at an affordable price and

- Can only be delivered from space and

- Can be scaled to make a small penetration into a very large market.

| Simple thought experiments suggest there is more than enough revenue potential in the global economy to fund several new commercial space industries that make use of new technologies, improved designs, and falling costs. |

These findings suggest two paths for growing the space industry: reduce the cost of space operations so that market penetrations larger than four percent become possible or develop new value propositions that make possible new penetrations into very large markets. These paths are not mutually exclusive. Indeed, falling costs help enable both expanded market penetrations and creation of new markets.

Simple thought experiments suggest there is more than enough revenue potential in the global economy to fund several new commercial space industries that make use of new technologies, improved designs, and falling costs. The most critical challenges for architects and engineers are likely to be creating compelling new value propositions, scaling the delivery of space services to very large markets, and producing significant reductions in costs. Large rewards await those who are most effective at seizing the new opportunities.