Small rockets, new and renewedby Jeff Foust

|

| Some satellites have had to wait a long time to get to space, but it seems easier—or, rather, less difficult—to get smallsats into orbit. |

There’s also growing optimism about the prospects for dedicated smallsat launch vehicles. Rocket Lab launched its first Electron in May, and just before the conference started, the company disclosed what happened to keep the rocket from reaching orbit. According to the US-New Zealand company, a contractor handing range safety misconfigured ground equipment, causing a dropout in telemetry that gave safety officials no choice but to terminate the flight, even though the company’s own, separate data stream showed no problems with the rocket.

Rocket Lab is now planning a second test flight of its Electron no sooner than early October, again from its New Zealand launch site. If successful, the company plans to forego a planned third test flight—“running another test flight won’t actually achieve much for us other than statistics,” Rocket Lab CEO Peter Beck said in an interview—and begin commercial launches by the end of this year.

Other companies are also making progress towards launches of their small vehicles. Virgin Orbit, the spinoff of Virgin Galactic developing LauncherOne, now expects to begin launches in the first half of next year, now that its 747 carrier aircraft has completed refurbishment. Vector, which carried out a very low altitude test launch in early August from the future site of Spaceport Camden in Georgia, expects to perform its first orbital launch some time next year.

Some of the more interesting developments in small launch vehicles involve companies that weren’t presenting or exhibiting at the conference, or have otherwise been shunning the limelight. One involves the quiet rebirth of one launch vehicle developer seemingly left for dead last year. Another is a company still operating largely in stealth mode.

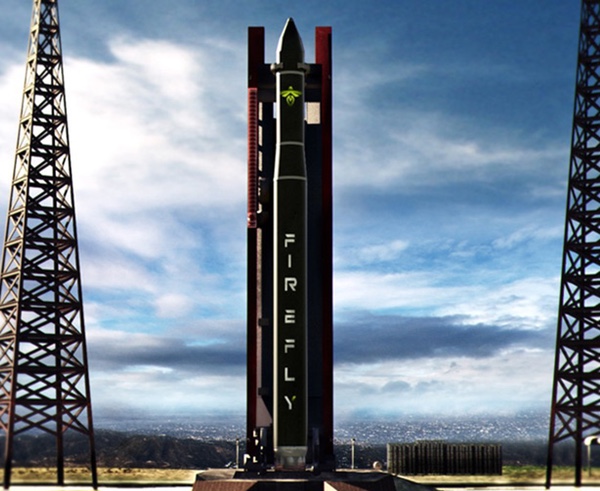

Firefly relights

Until last fall, one of the brightest stars of the small launch vehicle industry was Firefly Space Systems. The company, based in Texas, was developing a small launch vehicle called Alpha. It had raised tens of millions of dollars of funding and won one of three Venture Class Launch Services contracts from NASA—along with Rocket Lab and Virgin Galactic—in 2015.

At the end of September of last year, though, the company announced it was furloughing its entire staff when a planned investment round fell through (see “Will 2017 finally be the year of the small launcher?”, The Space Review, December 19, 2016). Little news trickled out in the months that followed, until the publication of public notices of bankruptcy auctions of the company’s assets earlier this year. Firefly, it appeared, had reached the end of the line.

However, Firefly—or, rather, a reincarnated version of the company—is back. Thomas Markusic, former CEO of Firefly Space Systems, said in an interview last month that the old company took out loans last year to keep the company afloat is it looked for new investors. That fundraising effort was unsuccessful and Firefly went into default on the loans. The creditors who held the secured debt foreclosed this spring.

But one of those creditors, a fund called Noosphere Ventures, acquired the assets of Firefly when they want up for auction in the spring. “After they acquired the assets they started a new company, called Firefly Aerospace,” Markusic said. He was brought back to the company as its president.

The new Firefly is now wholly owned by Noosphere Ventures, which Markusic said had sufficient money to fund Firefly’s development without the need to go out and raise additional money. However, he didn’t rule out raising some outside funding for “capital efficiency” but added it wasn’t necessary for the company to develop the Alpha rocket.

Firefly Aerospace had, as of last month, about 60 employees, and it continuing to hire. (The company just re-emerged on social media to promote its job openings.) Those employees include both people returning to Firefly as well as new people, and Markusic said he expects the company to grow to about 100 people—about two-thirds the size of Firefly when it had to furlough its workforce last fall—as development of its rocket ramps up.

| “I see the PSLV as kind of an existential threat to all of the domestic small launchers,” Markusic said. |

One change in the new Firefly will be the Alpha rocket. The original concept called for a vehicle able to place about 200 kilograms into low Earth orbit. Now, Markusic said, the company wants to make Alpha bigger, with a goal of 1,000 kilograms into low Earth orbit. That’s based on a reassessment of the launch market, in particular the growing use of rideshares on vehicles like the PSLV.

“I see the PSLV as kind of an existential threat to all of the domestic small launchers,” he said. “I wanted to be sure we could take that vehicle on head-to-head.” This upsized Alpha has a price goal of $10 million, or $10,000 per kilogram. “Ten thousand dollars per kilogram is a very good price for a small launch vehicle,” he said.

Firefly Aerospace has been in operation only since May, and other than its recruiting efforts is keeping a low profile. Markusic said he expects the company to soon release a payload users guide for the new version of Alpha, but for the moment isn’t actively selling the vehicle or doing other promotional work.

“We’re not going to be PR-heavy. We’re not in a big fundraising mode,” he said. “We’re in a ‘race to space’ mode.”

Tim Ellis, CEO and co-founder of Relativity, testifying before the Senate Commerce Committee’s space subcommittee July 13. (credit: Senate Commerce Committee) |

Special relativity

While the new Firefly Aerospace may not be “PR-heavy,” it’s still more open than some other companies in the sector that are in stealth mode, quietly working on technologies until they need to become more public to raise money or seek customers.

One example is Relativity. The company, based in Los Angeles, notes on its website that it is developing a launch service, but for now says nothing about its vehicles and its capabilities. “We are creating a new launch service enabled by never-seen-before technologies, allowing for enhanced launch certainty at significantly reduced cost,” the website states. The website includes a two-minute video that looks more like a trailer for a nature or historical documentary than a promo reel for an aerospace company.

That made the appearance by the company’s CEO, Tim Ellis, at a Senate hearing last month all the more noteworthy. While Ellis was there as one of several witnesses for a hearing by the Senate Commerce Committee’s space subcommittee on public-private partnerships, his testimony help shed a little light on their plans.

“We’re a stealth-mode startup creating a new launch service for orbital payloads, allowing for enhanced launch certainty at significantly reduced costs,” he said.

The company, he said, formed in 2016 in Y Combinator, a Silicon Valley business incubator that has been the genesis for companies like Airbnb and Dropbox. The company has since raised an “eight-figure” funding round led by venture capital firm Social Capital, he said (although Relativity does not appear on Social Capital’s portfolio of investments, perhaps because of Relativity’s low profile.)

Ellis was at the hearing because Relativity has a public-private partnership, in the form of a Space Act Agreement with NASA’s Stennis Space Center. “We are actively testing our liquid-oxygen/liquid-methane engines, with over six dozen hot fires in the past six months of testing,” he said.

| “We’re a stealth-mode startup creating a new launch service for orbital payloads, allowing for enhanced launch certainty at significantly reduced costs,” Ellis said. |

“Working with NASA has saved Relativity almost a year toward commencing hot fire testing, enabling us to meet our targets far sooner than if we had to build our own engine stand from scratch and it allows us to develop faster against our current funding timelines,” he added in his submitted written testimony. He didn’t disclose additional details, but a NASA document shows that NASA Stennis signed a Space Act Agreement with Relativity last August for “Aeon 1 Launch Systems Development.”

That agreement, he said, also allowed the company to focus more of its capital on its “other, never-before-seen technology innovations.” He didn’t elaborate on those innovations, but they are rumored to include the use of 3D-printing and automation to streamline vehicle production and reduce the amount of human labor needed to produce a rocket.

Ellis testified at the hearing to offer a wish list of policy improvements and other requests, including a concept called a “commercial space lease agreement” that would allow companies to lease test infrastructure at NASA centers, akin to leases of launch pads, to ensure access to those facilities. That, he said, would work better than existing Space Act Agreements where the company reimburses NASA for use of facilities, when those facilities are available.

He also commented on the lack of polar launch sites for “small class launch vehicles” in the US, suggesting that the company was thinking of launching its vehicles from a ship at sea. “The use of an offshore droneship launch platform, operating under an FAA license, could potentially alleviate this problem by allowing for launches in international waters,” he said. “The concept we envision is more like the reverse of the droneships and barges SpaceX and Blue Origin pioneered for landing recovered boost stages, versus the expensive Sea Launch platform.”

Nothing in Ellis’ comments, or written testimony, offer details about the capabilities of Relativity’s rockets, when they might enter service, or how much they might cost. But it does demonstrate that, while some companies have taken a high public profile, promoting every test event or customer signing, at least one more is working under the radar on similar capabilities. And there’s no reason to believe it is the only small launch vehicle developer still in stealth mode.