Pencils down: OmegA awaits final grade on EELVby Jeff Smith

|

| The previous placeholder name—Next Generation Launcher—simply wouldn’t do. Instead, you want a name that is easily recognizable and cool enough that anyone on the street will like it, and yet conservative enough the US government will spend hundreds of millions of dollars on it. |

This is the situation that Northrop Grumman Innovation Systems (NGIS - formerly Orbital ATK) and other rocket companies find themselves in as they await their final grade for the Evolved Expendable Launch Vehicle (EELV) competition. The United States Air Force is grading the reports of companies that want to launch satellites for the US military. The assignment had to be turned in by the November 20, 2017, due date: no late work would be accepted. But when the assignment is rocket science, the grading process takes time, and the Air Force even needs to ask the companies follow-on questions to ensure they give the right grade. At $100 million or more, the rockets are incredibly expensive. But, the Air Force uses these rockets to launch even more expensive GPS, reconnaissance, and communications satellites to defend the United States. The Air Force’s grading policy might be harsh, but there’s a reason for that.

Just as an enterprising student might bring in an apple for the teacher, the companies are using the time before final grades are handed out to try and remind the Air Force just how impressive their submissions each were. The 34th Space Symposium in April was the perfect opportunity to do this, where space companies give talks and presentations to inform and impress their military customer. The Air Force won’t post grades until later this summer and with the grading process underway, everyone is trying to make a good impression on the teacher.

OmegA: it’s all Greek to me!

When preparing your perfect school report, you want to start out with a snappy title, something that’ll draw the teacher in and make them want to read more. Having a strong title for a report is the same as having a great name for your rocket. The previous placeholder name—Next Generation Launcher—simply wouldn’t do. Instead, you want a name that is easily recognizable and cool enough that anyone on the street will like it, and yet conservative enough the US government will spend hundreds of millions of dollars on it. Good rocket names fall into one of three categories: a star or astronomical phenomenon, Greek or other mythological characters, or a name with an inside meaning to the group that built it.

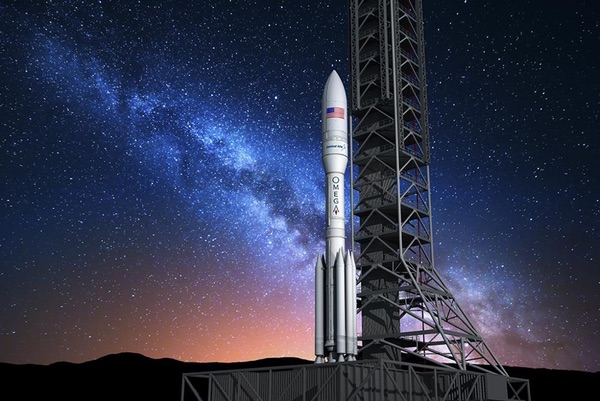

When given the three options for naming rockets, Orbital ATK picked all of the above. OmegA is a great name for a rocket, or almost anything else for that matter, sharing the name with watch companies, science fiction movies, and even comic book supervillains. Omega Centauri is the largest star cluster in the Milky Way, and omega, of course, is the last letter in the Greek alphabet. As for the inside meaning, the “O” and “A” in OmegA are capitalized to keep alive the Orbital ATK name.

It’s what’s on the inside that counts

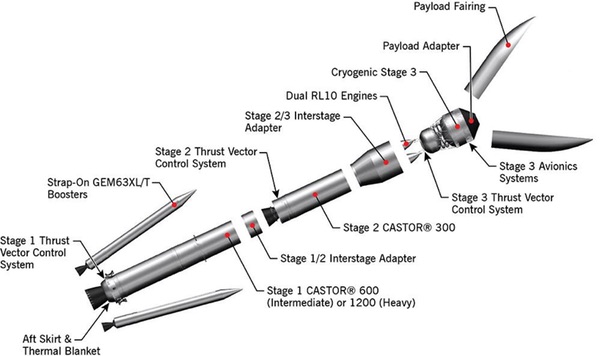

Expanded view of OmegA rocket showing the different components. (credit: NGIS) |

In addition to selecting a name, Orbital ATK also revealed important details about Omega’s design and construction. The single most important detail was that OmegA’s upper stage would be powered by 2 RL10C engines from Aerojet Rocketdyne. The RL10C-5-3 variant beat out competing cryogenic engines from Blue Origin (BE-3U) and Airbus Safran (Vinci). Having been manufactured and continuously upgraded for over 60 years, the RL10 is at the heart of the upper stages for three next generation launch vehicles: OmegA, Vulcanm and SLS.

Delta IV’s versatile Delta Cryogenic Second Stage (DCSS) also serves as the Interim Cryogenic Propulsion Stage (ICPS) for SLS. OmegA will use the same basic layout for its upper stage. (credit: NASA) |

The twin RL10Cs will power OmegA’s upper stage, burning liquid hydrogen (LH2) and liquid oxygen (LOX) propellants. OmegA’s upper stage uses the tried-and-true architecture of a fully separate LH2 tank sitting above a smaller LOX tank, similar to the upper stage used on Delta IV and SLS. This greatly simplifies the design process by allowing the storage and handling problems of LH2 and LOX to be dealt with independently. The overall rocket design is being performed in Chandler, Arizona, but the metal tanks for the upper stage will be fabricated and integrated with the RL10C engines at NASA’s Michoud Assembly Facility in New Orleans. Sharing the same production site as the SLS core stage, Michoud offers access to equipment and expertise to friction stir weld the pieces of the metal tanks, as well as water access to transport the completed upper stage. In America, large rockets are always built near water so they can be transported by barges on the Intercoastal Waterway and the Panama Canal to launch sites in either Florida or California.

With a final decision on the upper stage engine, the engineering team has been able to update the performance capabilities and publish increased payload carrying capacity. The maximum performance for the medium configuration has increased from 8,500 to 10,100 kilograms for geostationary transfer orbit (GTO), the most common orbit for communications satellites on their way to their final destination. Likewise, the maximum performance for the heavy configuration has increased from 7,000 to 7,800 kilograms to the final geostationary earth orbit (GEO). GEO is the final destination for communications satellites, but it’s an orbit that is rarely flown by the rocket itself because satellite companies long ago realized that it was cheaper to use the rocket to reach GTO and then use the satellite’s own propulsion system to raise their orbit the rest of the way until they reach GEO.

This increase in performance is a natural result of a rigorous (and conservative) design approach. Because a rocket’s final configuration can’t be fully known at the start of the process, engineers add margin—extra performance—into their design just in case components need to be heavier than planned or a rocket engine doesn’t perform as expected. As was the case with OmegA, when a rocket engine has yet to be selected, the design team takes a conservative approach and sizes the stage for the lowest performance rocket engine being considered (and then they add more margin on top of that... just in case.) As decisions are made and the design takes shape, the engineering team can reallocate that unused margin—because a component can be made lighter than first planned, or a highly efficient engine like the RL10 is selected—toward increasing the rocket’s published lift capacity. Sales teams love it when this process works in the right direction, and program managers lose sleep when it doesn’t. With the selection of the RL10, the OmegA team has been able to reallocate some of the margin they’ve been holding back. This process will continue as components actually get built and rocket stages get ground tested. Expect to see these performance numbers increase again next year after engineers have test fired some of their rocket motors and can definitively say that OmegA meets, or exceeds, their expectations.

A cutaway of OmegA, showing its three-stage design. (credit: NGIS) |

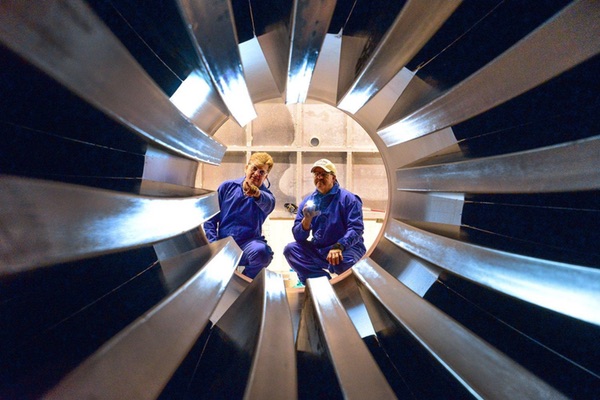

A close examination reveals the rest of the design to be highly optimized for each phase of Omega’s flight. The first stage has a wide center bore—the the empty space running down the center—and a large diameter throat to accommodate the high thrust required. The first stage is separated into two segments: the upper one features a “finocyl” shape to give increased thrust at ignition, while the lower segment features a “conocyl” design that opens toward the bottom like the bell of a trumpet to give the expanding gases enough room as they travel downward toward the nozzle. (A conocyl is what you get by joining a CONe to a CYLinder, while a finocyl comes from putting FINs on a CYLinder—what engineers lack in creativity of their names, they try to make up for with descriptiveness.) The upper stage features a finocyl with a narrower bore, appropriate for its lower thrust. It also features an efficient nozzle with a high expansion ratio (the ratio between the size of nozzle at its widest part to its narrowest part).

| A common complaint heard about large solid rocket motors is that they lack the ability to be throttled while in flight. This isn’t really true. |

All of OmegA’s solid rocket motors will make use of the latest in solid propellant technology. Whereas liquid propellant stages (like OmegA’s upper stage) require the skills of a rocket plumber, solids need a rocket baker. The go-to solid propellant recipe (technically called the formulation) developed by the former ATK uses HTPB rubber to “glue” particles of aluminum fuel and AP oxidizer together. The liquid rubber is mixed with aluminum metal and AP powders before being poured into a massive cake mold (think 350,000 pounds massive) and then baked in the oven. There’s no Kitchen Aid big enough to mix all that rocket batter at the same time, so instead of the five-quart mixer in your home, the professional rocket bakery uses 600-gallon mixers that hold a mere 6,000 pounds of propellant and they simply do that 55 times to fill up a single cake mold. While a gourmet pastry chef wants air in their baked delicacies to give a light and fluffy texture, rocket bakers want something more like a PowerBar: a dense lump that packs as much energy into as small of a space as possible. To achieve this, rocket bakers will closely control the size of the individual powder particles to make the mixture as dense as possible—imagine granulated sugar with even smaller powdered sugar mixed in to fill in the already tiny gaps between individual granules, and you’re not too far off—to minimize the amount of rubber needed to glue it all together.

HTPB rubber allows the amount of low-energy glue to be reduced from 14 to 12 percent of the recipe and the high-energy aluminum to be increased from 16 to 18 percent of the mixture. HTPB is more efficient than the PBAN glue previously used for the Space Shuttle and requires less of the glue to hold the powders together and still prevent the cake from caving in on itself or otherwise deforming. When it comes to launching massive satellites, both rocket plumbers and rocket bakers alike will use every trick in their cookbook to get that last ounce of performance.

The inside of a solid rocket booster for NASA’s SLS, the finocyl design can be clearly seen. (credit: NGIS) |

A common complaint heard about large solid rocket motors is that they lack the ability to be throttled while in flight. This isn’t really true. Whereas the designer of a liquid rocket engine performs this task with mechanical plumbing (think of how you can control the flow of hot and cold water at your bathroom sink), the designer of a solid rocket motor performs the same task with the chemistry and shape of the rocket motor and the size of the throat, the opening at the bottom. Think of a candle and how its width, the choice of paraffin or beeswax, and the size of the wick changes how quickly it burns down. Narrow candles burn down faster than wide candles, some waxes burn faster than others, and large wicks burn faster and brighter than small ones. By carefully choosing these parameters, a solid rocket motor designer can tailor the performance of the rocket to exactly what they want.

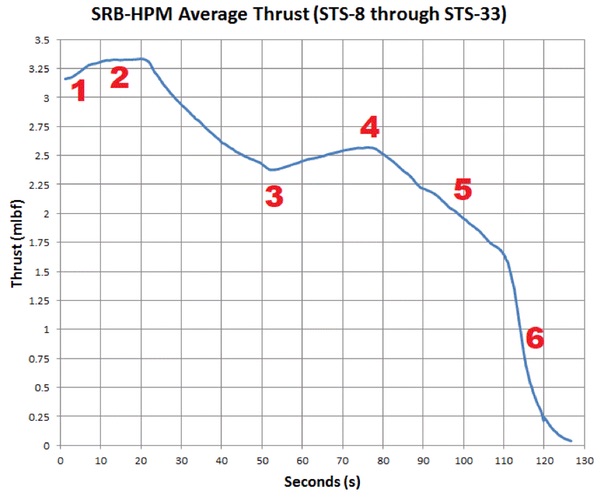

Graph of thrust (in millions of pounds) for the Space Shuttle’s Solid Rocket Booster, upon which OmegA is based. Phases of the flight are number. (credit: Alternate Wars) |

The Space Shuttle, like all high-performance rockets, used all of these tricks to great effect. Not only did the shuttle have stages, but each stage was also meticulously designed to deliver the exact performance at precisely the right time. The shuttle’s SRBs (on which OmegA is largely based) reveal each individual phase of their two-minute operating time:

- Initial low thrust until the rocket clears the launch pad to prevent damage to the launch pad and reduce the sound energy that bounces off the ground and back onto the rocket,

- Max thrust to accelerate upwards as quickly as possible and minimize the time gravity can slow the rocket down,

- Reduced thrust—called a MaxQ bucket—to reduce the maximum air drag on the rocket while it’s going fast at low altitude, where the atmosphere is thickest,

- Speeding up again, but this time not quite as much as before to account for the fact the rocket now weighs substantially less and could inadvertently accelerate beyond the rocket structure’s ability to withstand,

- Gradual reduction in thrust as the rocket burns the last of its propellant and becomes it lightest, and finally,

- A gentle shutdown prior to separating from the next rocket stage.

|

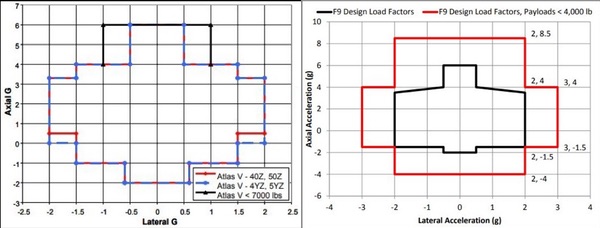

Another complaint about solid rocket motors is the amount of vibration they produce. Of course, the solid rockets of the Space Shuttle helped deliver some of the most iconic spacecraft of the last 30 years: the Hubble Space Telescope, most of the International Space Station, and all the astronauts that rode it into orbit. Also, because most satellites aren’t designed to launch on a single type of rocket, nobody’s rocket can produce more than the next guy’s if they hope to compete for satellite contracts, whether they be commercial, civil, or defense. As can be seen by comparing the max G-force charts from either Atlas V or SpaceX, all rocket designers must shoot for a rather narrow window (about 6 Gs max for most satellites) to ensure payloads will arrive to space undamaged. OmegA is designed to meet these requirements just like any other rocket.

| There are only two fundamental equations in the rocket business. The first comes from Sir Isaac Newton’s laws of motion: force is equal to mass times acceleration. The second was discovered much earlier: profit is equal to revenue minus cost. |

Of course, rockets have to launch from somewhere, and OmegA is now looking to use former Space Shuttle launch pads on both coasts. East Coast launches will still use Pad 39B at KSC (Kennedy Space Center), but West Coast launches may occur from SLC-6 (Space Launch Complex 6) at VAFB (Vandenberg Air Force Base) instead of SLC-2. This makes sense because SLC-6 was originally the West Coast launch site for the Space Shuttle to reach polar orbits, and as such, it has sufficient size and the equipment to handle OmegA. This change is a result of the fact that SLC-6 will be freed up when Delta IV Heavy finishes flying from there. The future vacancy of SLC-6 reflects the fact that ULA’s Vulcan rocket will be more the spiritual successor to Atlas V rather than to Delta IV.

The other rocket companies can’t afford to stand still either. ULA is modifying their Atlas V launch pads to accommodate Vulcan. Last year, ULA had accelerated the growth of Vulcan’s second stage to the final 5.4-meter diameter. Similarly, ULA has recently been showing images of Vulcan with an even larger diameter of the Vulcan’s first stage. Originally, ULA had planned to use a modified Delta IV first stage with a diameter of five meters, but now they have obviously decided to grow the first stage to match the second stage. Blue Origin has also modified the design of New Glenn by changing the second stage to use the same BE-3 that will be on the rocket’s third stage. Along with SpaceX’s recent Falcon Heavy test flight, each team is furiously trying to put the finishing touches on their work before the teacher calls “pencils down.”

The business of rockets is business

There are only two fundamental equations in the rocket business. The first comes from Sir Isaac Newton’s laws of motion: force is equal to mass times acceleration. The second was discovered much earlier: profit is equal to revenue minus cost. If a rocket cannot solve both of these equations at the same time, the math won’t work and the rocket will never fly. If the rocket’s engine does not produce enough force, it will not accelerate the rocket’s mass off the launchpad. Likewise, if the rocket cannot be sold for more than the cost to produce it, there will be no profit.

All successful rockets can solve both of these equations. But, in addition to achieving both the engineering and business goals, we are now seeing rocket companies having their own ideologies, with goals and visions for humanity’s future. This phenomenon is linked with the space industry adopting the rockstar-CEO culture of Silicon Valley.

You can actually play a fun word association game with each rocket company: who’s the leader, what is their design philosophy, and what is their grand vision for mankind? SpaceX is easy: Elon Musk wants to use high technology to lower costs and reach Mars. Blue Origin isn’t difficult either: Jeff Bezos has been public about his slow-and-steady approach to expanding humanity to the Moon and beyond. Even the very traditional ULA has gotten into the act with Tory Bruno promoting his company’s perfect reliability to support 1,000 people living and working in cislunar space.

At a time of visionary space companies, the former Orbital ATK steadfastly stuck to the traditional government contractor model of performing their work out of the spotlight, in near anonymity. Even their old tagline, “The Partner You Can Count On,” was chosen to make absolutely certain that everyone understood “it’s not about us, it’s about what we can do for you.” While the grand vision may be lacking, the design philosophy is crystal clear: low risk. When competing against the low prices of SpaceX or the incredible reliability of ULA, it’s hard to stand out. But, by playing to the solid rocket motor experience of the former ATK and choosing the highly regarded RL10 engine, the OmegA team has created a design that shouts “zero technical risk” at anyone who reviews the proposal.

| Northrop Grumman’s acquisition of Orbital ATK has only strengthened an already vertically integrated business. This can be particularly attractive with two categories of customers. |

The absence of fantastic pronouncements may not attract crowds of adoring fans, but for its intended customers, this low-key approach can be a major part of OmegA’s appeal. Just as each rocket company is pursuing a different design philosophy, different customers will be attracted to each rocket provider based on their unique strengths. SpaceX’s low prices have been a resounding success with commercial satellite companies while ULA’s perfect record has secured them a complete monopoly, for now, of launching large defense satellites, with SpaceX just recently making inroads in that market. This is a classic example of product differentiation, or how companies in a crowded market will alter their goods or services to distinguish themselves from their competitors in order to gain a competitive advantage. Just as a product’s features—price, reliability or customer focus—can be a way to differentiate a company’s offering, a publicly stated philosophy (or lack thereof) can also attract or dissuade potential customers.

Northrop Grumman’s acquisition of Orbital ATK has only strengthened an already vertically integrated business. This can be particularly attractive with two categories of customers. One is those that don’t want to maintain a skilled contracting team to evaluate launch vehicles and other technical details. This group simply wants to pay for a satellite’s capabilities “as delivered” and not oversee every aspect of the design, construction, and launch process.

The second group of customers that will find OmegA particularly attractive are those that put a special premium on security. This group wants to keep to the bare minimum the total number of people and companies that work on a project. In some situations, it’s not enough to be able to watch someone with your spy satellite; you don’t even want the other guy to know you’re doing it. The effort to keep information about an activity from getting out is called operations security. The example that proves the rule was the loss of the Zuma satellite on January 8. It’s unfortunate whenever an expensive national security satellite is lost, but the real problem came when a public back-and-forth erupted between high-profile companies who, understandably, wanted to protect their reputations. This type of situation causes nightmares for security professionals. These unpleasant conversations are supposed to take place behind closed doors where the government organization can find the root cause of the issue and the contractors can accept responsibility, learn from the failure, and get it right the next time when they get the replacement contract.

The natural tension on such classified projects is between limiting the number of people who fully understand the details (need to know) and the need to share those details broadly among everyone to make sure that no small issues are missed. This problem becomes exponentially more difficult when information has to be shared across multiple organizations. Instead of questions being answered between coworkers in the hallways, all information gets communicated via formal documents between groups with different corporate cultures and corporate languages. While it can never be known, the key question that could have saved Zuma may very well have been asked, but the other side of the conversation may not have even properly registered what the question was asking, with all of its implications.

Vertical integration may make OmegA especially attractive to these security-conscious customers. By consolidating every aspect of a classified satellite’s life in a single company, it becomes much easier to maintain the open communication necessary to ensure a project is successful while ensuring the highest levels of security. Even though it’s fundamentally not true, Las Vegas has been wildly successful with the catchy slogan, “What happens in Vegas, stays in Vegas.” A very similar slogan may pop up in the classified world, “OmegA: because no one else needs to know.”

To EELV, and beyond!

The OmegA team was informed that they had checked all the technical boxes and would be eligible to win an award to build and fly a demo version of OmegA. While this is no guarantee, receiving that kind of feedback early is a great confidence booster for any team: it means they have passed that initial hurdles and they are still in the running.

While OmegA has a lot to be enthusiastic about, not every rocket company is so vocal about the EELV competition. Blue Origin has been staying rather quiet about the company’s widely suspected EELV submission. This may indicate that Blue Origin isn’t fully confident they’ll get selected for this round of the EELV competition. While no one likes to come up short on such a public stage, if this is part of a longer-term strategy, not getting an award this time around wouldn’t be a failure at all and would actually result in useful feedback for future efforts. The aerospace industry is deeply rooted in personal relationships where industry suppliers and government customers get to know each other, how they each operate, and each other’s design philosophy. Developing and maintaining these relationships takes time, and there’s no time like the present EELV competition to start that process with the Air Force.

| The contract for serial production could be awarded as soon as 2019, years before a demo flight could reasonably occur. This puts the Air Force in the difficult position of having to make a long-term decision based not on the performance of the rocket itself, but instead on the progress of the design process. |

In addition, even though the rules of this competition didn’t make prior government contracting experience part of the scoring system, this is another area where Blue Origin lacks the benefits of an experienced government contractor. Even on projects that the Air Force has funded—development of the BE-4 with ULA and designing a composite nozzle for the BE-3U with Orbital ATK—Blue Origin is a subcontractor on those projects to established prime contractors, who each have extensive experience in system integration. In government contracting, subcontractors are simply viewed differently than the prime contractors they supply, with correspondingly different expectations about the level of responsibility and their technical expertise. As Blue Origin demonstrates these skills with successful launches, they’ll be able to distinguish themselves as a competent team able to integrate and operate highly complex systems. Unfortunately, this all takes time.

Falcon and OmegA are both in this competition precisely because their teams have been through that process. In the same way that Falcon 9 owes its success to the experience the SpaceX team gained on Falcon 1, OmegA owes much to Orbital ATK’s Antares rocket. The design and flight teams had to learn many lessons during the development and operation of Antares, lessons they are using on OmegA today. Antares was the team’s first experience with cryogenic propellant as well as choosing a liquid rocket engine (the Russian NK-33). The team then learned the painful lesson of what can happen if you rely on an engine that you don’t fully understand when an Antares spectacularly crashed back on the launch pad in October 2014. Orbital ATK clearly learned this lesson because they replaced the out-of-production, not-fully-understood, and low-cost NK-33 with the modern, in-production, and more expensive RD-191, an engine with a long and successful heritage of launching many spacecraft into orbit. The lessons learned from Antares gave that same design team the confidence to take on the challenge of designing a cryogenic upper stage for OmegA, but also tempered that confidence with the caution that led to choosing the proven RL10 over the unproven BE-3U or Vinci engines.

This intentionally low risk approach makes the OmegA team confident they’ll win an award to build the first OmegA for a demonstration flight. When judged against the EELV competition criteria and considering the rest of the launch industry as a whole, this confidence is clearly justified. There should be no surprise when OmegA gets selected for a demo test in 2021. NGIS is also putting their money where their mouth is, and is on a hiring spree to get the needed engineering and manufacturing talent in place to support this aggressive schedule. The Antares team already demonstrated this ability when they went from award to first flight in just two and a half years, and this time there are no suppliers on the other side of the globe to worry about: it almost makes it seem easy. But the team can’t sit on their laurels, because the contract for serial production could be awarded as soon as 2019, years before a demo flight could reasonably occur. This puts the Air Force in the difficult position of having to make a long-term decision based not on the performance of the rocket itself, but instead on the progress of the design process—particularly if there are any surprises that pop up during ground testing that look like they might derail a rocket’s viability. Considering the award of production contracts will be based on design progress, it makes the decision to eliminate any unnecessary risk that much more important.

By accelerating the development of the full-sized Centaur upper stage and sizing Vulcan to carry heavy class payloads from the outset, ULA is trying to position Vulcan as the rocket of choice for the heavy-lift category. These are the largest and most expensive launches the Air Force buys (not coincidentally, they also pay the highest profit margin.) This is a rational business decision that plays to ULA’s unrivaled, perfect success record. With SpaceX’s Falcon Heavy also vying to win the same launch contracts, the small “heavy” market is already looking rather crowded. The launch rate for previous “heavy” rockets like the Titan III Centaur and Titan IV used to be two per year, but that number has fallen during the Delta IV Heavy-era to barely one per year, and none at all in 2017. With such an oversupply for such a small market, it’s seems unlikely the OmegA Heavy will get funded for a 2023 demo flight. The relatively tiny market for heavy rockets aside, winning a position in the EELV competition would be a tremendous accomplishment.

Even if OmegA only gets a minority of the medium-lift contracts, it will still be doing vital work to support America’s defense and play a strategic role for as the Air Force seeks to shape the launch market. While two launch providers are necessary for the military to have “assured access to space,” that isn’t enough to ensure a healthy and competitive marketplace. The US government knows that pricing strategies become exponentially more difficult for companies when additional vendors are added to a competition, and they’ll likely get a lower prices as a result. In the same way the government will use Falcon to keep Vulcan prices in check, look for OmegA to be used to keep Falcon prices in check. There is already some evidence of this on NASA’s COTS program for delivering cargo to the International Space Station. For the second phase of program, SpaceX’s prices rose by 50 percent while NGIS’s (formerly Orbital ATK) prices fell by 15 percent. The US government has been in the contracting game for a long, and they have their own tricks for getting a good deal.

Don’t be surprised if in a few years, the breakdown of rocket suppliers for defense launches looks something like this: SpaceX wins the lion’s share of the number of launches, somewhere between a third and half of all launches, but mostly in the medium category, with a few launches in the heavy category to apply price pressure to Vulcan. Under such a scenario, ULA would likely win a quarter to a third of launches, getting most heavy launches and many of the most sensitive medium launches. Even though the number of flights will be less, the total dollar value will probably be same as, or even greater than, SpaceX’s. This still leaves a fair number of defense satellites for OmegA to launch, particularly for satellite families like GPS—the bread-and-butter of military launches, and the one SpaceX used to enter the defense market—where the Air Force has 32 third-generation GPS satellites to launch.

While NGIS needs to sell three to four OmegA launches per year to be economically viable, they would much rather sell upwards of eight flights a year. With so many entrants into the defense launch business, it’s a buyers market and the Defense Department will be able to spread the launches around to maintain a competitive environment with the accompanying lower prices. This will make it impossible for any company to rely strictly on the defense market to close their business case. But, SpaceX, ULA, and NGIS already have alternate income streams so they don’t have to depend on solely on their Air Force customer. While SpaceX is doing excellent business in the commercial satellite market, they will continue to provide NASA cargo delivery flights to the ISS and are moving up-market with crewed Dragon flights soon to begin. Vulcan can similarly expect to launch Starliner and Dream Chaser flights to deliver crew and cargo to the ISS as the Atlas 5 is phased out.

It will be interesting to see how OmegA solves this same problem and a lot of that will depend on how aggressively NGIS approaches this business. While winning a spot in the current competition is enough to get OmegA’s foot in EELV door, NGIS may have to make some tough decisions if they want to get all the way inside. Orbital ATK already had several revenue streams, but they are spread across various efforts that may need to be consolidated if OmegA is to be successful. To that end Orbital ATK (now NGIS) has already broached the subject of using OmegA to launch the communications satellites they build with their commercial customers. For their ongoing NASA business, which sees approximately two Cygnus spacecraft per year delivering cargo to the ISS, NGIS has informed NASA they have contingency plans to switch to OmegA if their access to Russian rocket engines is jeopardized, or presumably, if it makes financial sense to have just one large rocket. Of course, the occasional classified launch for “an undisclosed US government customer” wouldn’t hurt at all.

Even before the Northrop Grumman acquired them, Orbital ATK was already showing more aggressiveness to win business that had historically been held by others. They convinced ULA to make them their sole provider of solid rocket boosters for the future Vulcan and the existing Atlas V, work that has always gone to Aerojet in the past. Orbital ATK did this by agreeing to fund the development of the GEM 63 SRB themselves, with a plan to use this new rocket motor on their own OmegA rocket. While they certainly ran the numbers to ensure they wouldn’t lose money, they may only be breaking even with ULA. The real windfall will come when NGIS is building those SRBs for their own OmegA launches.

OmegA’s composite-case solid rocket motors are designed to the same size as the Space Shuttle and Space Launch System SRBs, so they can replace the current metal cases in the future. (credit: NGIS) |

| The current EELV competition is focal point of trends that that are decades in the making. This also represents the healing of the schism between the Air Force and NASA. |

Finally, the last business that NGIS can draw on to cement OmegA success is NASA’s SLS. As an aerospace company that maintains those oh-so-important relationships with their customers, OmegA’s design team has included outside experts in their critical engineering reviews to ensure independent minds can point out anything the team may have missed. With so much of OmegA’s design relying on technology evolved from the Space Shuttle’s SRBs, it’s only natural to invite the experts from NASA’s Marshall Space Flight Center, the NASA facility that had design responsibility for the shuttle’s—and now SLS’s—solid rocket boosters. This is one of the ways that traditional space organizations communicate with each, by have each other at their reviews, showing them their work, and asking for constructive criticism. Clearly, the experts from Marshall like what they’ve been seeing, because they just released a request for information, tailored to ask the NGIS team how this technology can be adapted to SLS in the 2020s. If NGIS can win all, or even just most, of these business opportunities, OmegA is likely to have a long and profitable future.

Conclusion: tight budgets make strange bedfellows

The current EELV competition is focal point of trends that that are decades in the making. It’s allowing new entrants to participate in launches that are critical to America’s defense and is forcing traditional companies to rethink how they do business. Add to this a constrained budget environment and everyone is scrambling to get a piece of what may ultimately be a smaller pie.

This also represents the healing of the schism between the Air Force and NASA when the Space Shuttle couldn’t meet the flight rate originally envisioned by its designers. While the shuttle was able to perform the most remarkable feats of its day—launching and maintaining the Hubble Space Telescope and building the International Space Station, to name just two—it showed it wouldn’t be able to launch frequently enough to perform the day-in-day-out duty of launching dozens of GPS satellites or routinely replacing aging reconnaissance satellites. Instead, both organizations went their separate ways, with each becoming entrenched in their own rockets for a generation, the Air Force with upgraded versions of the Atlas and Delta rockets and NASA with the shuttle.

Current and future rockets in the US. No single country has ever had so many large rockets in development at the same time before. (credit: NGIS) |

Contrast that with today’s situation. NASA is preparing to launch astronauts on the Air Force’s Atlas V while the Air Force is launching GPS satellites on the Falcon 9, developed to support NASA’s commercial cargo program. The Air Force is even seeking to continue the process started with NASA’s COTS program, which ostensibly was established to deliver supplies to the ISS but had the secondary goal of kickstarting a truly competitive space launch industry. NASA was the original patron of the Falcon 9 which the Air Force is now embracing, and its pinnacle, the Falcon Heavy, will probably find its greatest customer with the Air Force. The Air Force’s Atlas V and its successor Vulcan will launch NASA astronauts, while NASA’s Ares I has become the Air Force’s OmegA, using technology that will find its way back into NASA’s Space Launch System. New Glenn and (perhaps) Vulcan will share the same BE-4 on the first stages. And to top it off, SLS, Vulcan, and OmegA will all use the RL10 engine on upper stages, which the Air Force is paying to upgrade.

If all of this seems complicated, it’s because it is. The space industry is changing at a rate that hasn’t been seen since the days of the original space race. Everyone is scrambling to adapt to rapidly changing markets and political situations. One thing is clear: NASA COTS program has been unimaginably successful. NASA sought to kickstart the space launch market by involving new companies to launch cargo to ISS. With this latest launch competition, it appears they’ve kickstarted the defense launch market too.

Now everyone is just waiting for their final grade.

Note: we are temporarily moderating all comments subcommitted to deal with a surge in spam.